DECISIONS

If you have a challenging business decision to make, we work closely with you to assess the situation, evaluate the options and arrive at realistic solutions and executable plans…

… and when complexity and uncertainty is a constant – provide decision trees, contingency plans and if necessary on the ground execution support…

Strategy

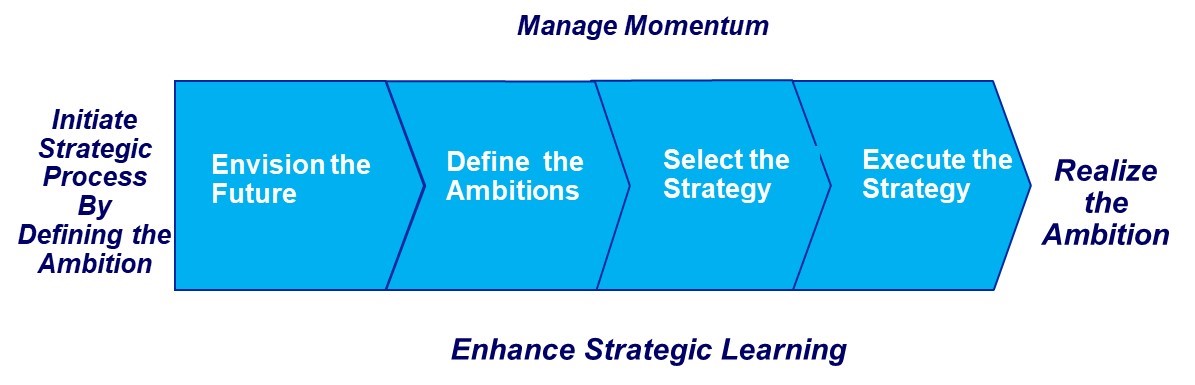

At EGP, strategy is not a conceptual framework...

...nor does it begin from a condition driven departure point to a brighter tomorrow…

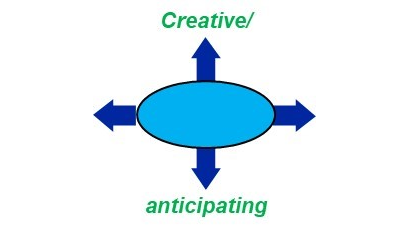

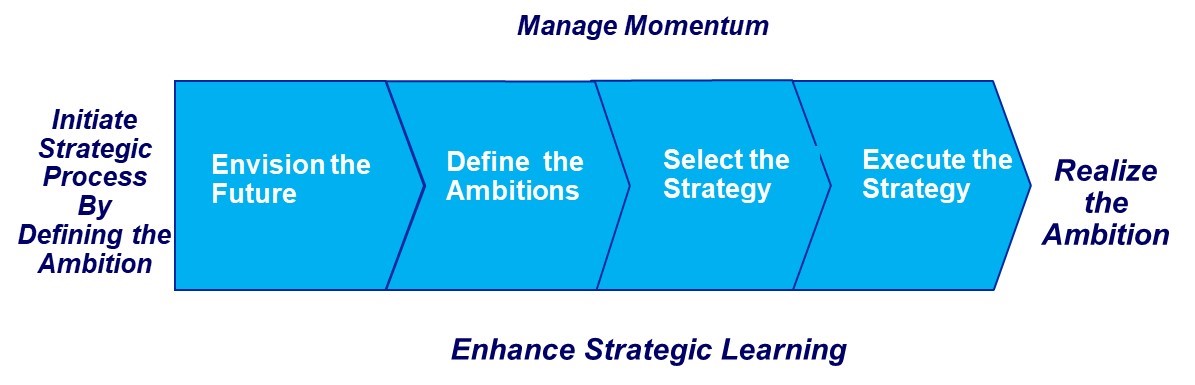

… Its envisioning who you want to be tomorrow and creating that future through an orchestrated process to ensure good decision making to realize that future…

Envision the Future

Define the Ambition

Select the Strategy

Execute the Strategy

Ambition Driven Strategy

Condition Driven Strategy

- Strategy is pulled to meet objectives within a realistic view of the future ...

- ... not pushed by the past

- The organization and resources are aligned ...

- ... instead of unaligned

- The organization is active ...

- ... instead of reactive

Ambition Driven Strategy |

Condition Driven Strategy |

|

|

|

|

|

|

|

|

|

|

|

|

Please contact us if we can be of assistance in meeting your strategic ambitions, market or business entry challenges or other strategic and tactical needs….

M&A ADVISORY

Overview

As both an extension - and independent of our Strategy Practice - EGP works with corporations and private equity in the chemicals, materials and related sectors to offer a tailored, differentiated and truly value-added service to ensure good client decision making…

…Targeting, prioritizing candidates, strategically evaluating, performing due diligence and participating in the negotiating process to close transactions with and/or for our clients.

The EGP team all have over 25 years of global industry knowledge & experience, has navigated cyclical ups and downs, and can provide the nuanced insights – beyond the analytics and numbers - on which transactions work and which are likely to fail.

THE THINGS WE DO....

Identification:

• Vision/Strategy Validation

• Acquisition Objectives

• Define Target Universe

• Screening Criteria

• Candidate Background

• Candidate Screening

• Build Industry Contacts

Selection:

• Candidate Profiles

• Strategic Assessment

• Economic Assessment

• Feasibility Assessment

• Candidate Prioritization

• Compelling Stories

• Report to Management

Transaction:

• Contacts, Confidentiality Agreements, LOI

• Candidate Background

• Due Diligence

• Confirm Strategic and Economic Benefits

• Price and Terms

• Contingencies

Integration:

• Integration Team

• Short-term Transition Plan

• 12-18 Month Operating Plan

• 5-year Strategy Plan

Transactional Support

Specialties

- Commercial due diligence, deal structuring and negotiation support on an acquisition, related JVs, and related supply and sales agreements in the Indian specialty chemical industry

- Acquisition DD (operational, commercial and technical) of a Turkish plastics additives manufacturer positioned in the ME, Europe and the US

- Manufacturing asset due diligence in the US for several companies encompassing paints, surfactants, oleochemical and specialty additives deals

- For various US, European and Asian firms, performed specialty chemical opportunity assessments and developed M&A strategies, including candidate search and evaluations in NA and Europe

- Identification and evaluation of new business platforms via roll-up acquisition. Sectors (chemicals, devices and/or services) including human and animal health, air/water purification, food ingredients and nutritional supplements, food safety testing, smart packaging, I&I cleaners and anti-microbial materials.

- DD support for acquisition and then sale of leading SBC producer for PE buyer/owner

- Commercial and technology DD of an aroma chemicals company

- M&A advisory assistance, including screening targets and initial negotiation support, for entry into the food additives business.

- M&A advisory assistance for a consumer products company planning entry into the natural preservatives, colors and probiotics

Polymers & Materials

- Assisted several US and European clients in Acquisition and divestiture and supply chain strategies. Support focused on screening and valuing targets. Divesture and supply chain strategies focused on decisions to maintain vs. ‘optimizing’ / shutdown decisions. Markets included commodity polymers, PUR & intermediates., ETP/TPEs, rubber, Cmpds and additives

- JV Advisory Assistance for a plastics compounder seeking Asian expansion, including negotiations, MOUs, LOIs, contracts & proposed commercial terms

- Performed DD for a US MNC acquiring assets in China, while deploying and operating a coal gasification facility supporting a downstream industry undergoing restructuring

- DD on Dow’s global styrenicsand TPE business for a private equity firm

- Advised a US firm with China based manufacturing exporting to the “West”, on positioning in the Chinese market., including market assessments, channel and supply chain analyses in Coastal and Central China, alliance targeting and strategy development

- Advised two Korean companies with business interests across Asia, on merger valuation, equity share and operational integration. This required the valuation of both firms’ commercial activities, assets, operations, technology, accounts, cash flow, management capabilities, etc

Life Sciences

-

DD for the acquisition of a US medical device company for a European firm’s ambition to leverage their combined strengths to service Tier 1 companies in the West, Asia and Latin America. A complete technical, operational and commercial DD was performed

- Due diligence for a MNC plastics converter serving multiple industrial end-use markets targeting a contract precision injection molder in the medical device and products market

- Scanned industry segments and identified acquisition targets for an EU based food ingredient/additives supplier seeking new products and a US operations platform

- For an EU fine chemicals firm positioned in multiple segments and seeking a US manufacturing position, screened 200 candidates and helped select a short list of six acquisition targets

Developed an M&A strategy for an EU firm’s growth in pharma intermediates and generic/OTC bulk actives. Identified, evaluated, screened & provided initial

-

Hands-on advisory assistance on medical product development, including concept generation, design reviews, marketing meetings, & program management. Areas included blood processing devices and disposables, surgical fluid warming system, orthopedic surgical pump and venous access development programs

Industrial & Mining

Assorted Aviation Industry deal DD support:

- Acquisition of an avionics, and engine maker

- Advisory to creditors in a bankruptcy case

- A Government entity on whether to continue financing two major airlines

- Post-merger support to improve an aviation components maker’s revenues, margins and operational effectiveness

- Worked with management Team of a $500 million seat supplier, transforming it into an $18 B global vehicle interiors system supplier. Identified key M&A targets and supported transaction DD.

- Helped create a $1 B new business in auto components by structuring a series of over 12 JV and M&A transactions

- Conducted DD on UV curing systems and inkjet printing for a diversified UK company

Advisory assistance and investment models for:

- Establishing a ME wire cloth plant

- Establishing a ME plastic films and sheet plant

- Manufacturing metal foils in the US, Europe & China

- Steel galvanizing production facilities

- Water, air treatment & filtration systems

For Domestic Mining Companies:

- Developed an investor consortium to develop a W. African iron ore deposit

- Assisted in raising capital to initiate minerals mining

- Developed a consortium of investors for a major W. African alumina project

- Performed a USGC iron carbide feasibility study for a SA iron ore producer

OPERATIONS

Bringing Strategy and Operational Effectiveness Together

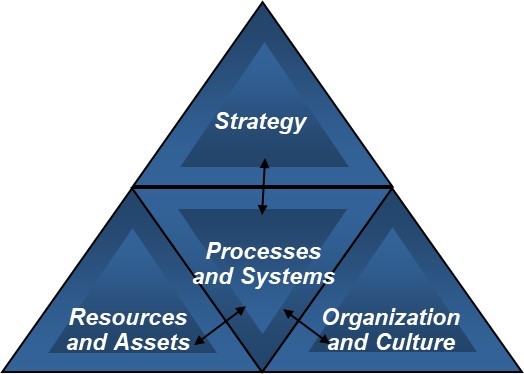

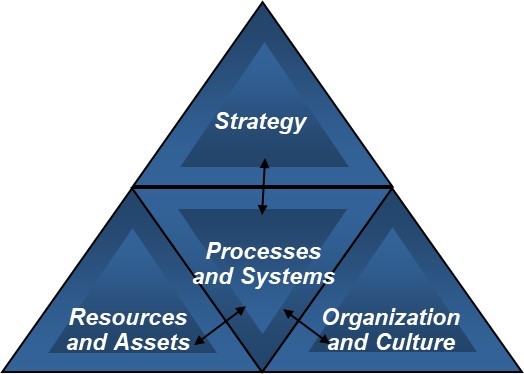

Strategies are not effective in conceptional silos, but only when they’re operationally integrated…

…In the ever-changing dynamic world we live in, creative strategies need not only to be in alignment with local, regional and/or global ambitions, but requires an effective holistic approach that integrates strategy, resources, organization and process into practical and implementable action plans…

Strategy, M&A and Alliance Structuring

- Develop an Ambition Driven Strategy for the business and/or country

- Understanding the corporate and/or country culture and designing strategies that are uniquely successful with the business-country context

- Understanding the most effective operating structure and pursuing M&A, JVs and or alliances accordingly

Resources and Assets

- Evaluate if internal/external resources are deployed effectively

- Assess funding adequacy

- Determine whether resources can meet strategic objectives

Processes and Systems

- Developing appropriate business processes

- Aligning customer service with key accounts

- Measure the effectiveness of systems within a country context

Organization and Culture

- Culture assessment

- Design effective Corp-local organization that is locally attuned and "best practices" equipped/trained

- Incentives, motivators, and behavior drivers

- Structuring teams that are creative - globally & locally - to deliver results

Strategy, M&A and Alliance Structuring

- Develop an Ambition Driven Strategy for the business and/or country

- Understanding the corporate and/or country culture and designing strategies that are uniquely successful with the business-country context

- Understanding the most effective operating structure and pursuing M&A, JVs and or alliances accordingly

Resources and Assets

- Evaluate if internal/external resources are deployed effectively

- Assess funding adequacy

- Determine whether resources can meet strategic objectives

Processes and Systems

- Developing appropriate business processes

- Aligning customer service with key accounts

- Measure the effectiveness of systems within a country context

Organization and Culture

- Culture assessment

- Design effective Corp-local organization that is locally attuned and "best practices" equipped/trained

- Incentives, motivators, and behavior drivers

- Structuring teams that are creative - globally & locally - to deliver results

At EGP, we are experts at developing action plans that allow you to deploy, position, compete and grow by anticipating global, regional and/or local change and uncertainty…

TECHNOLOGY & INNOVATION

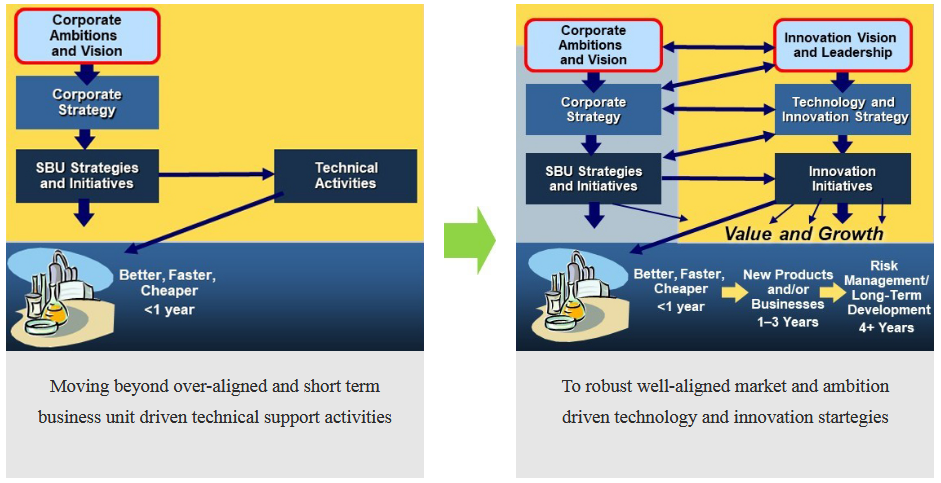

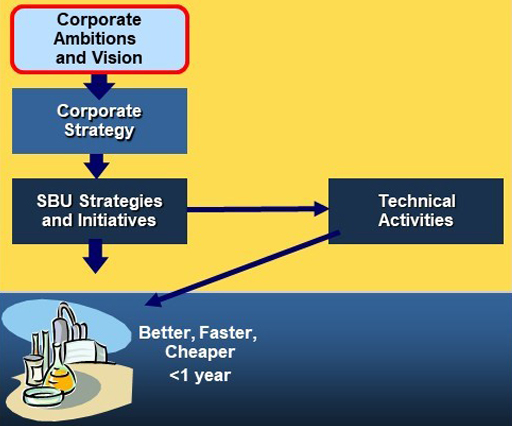

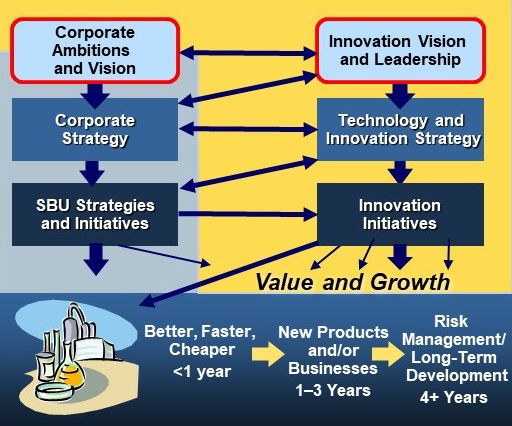

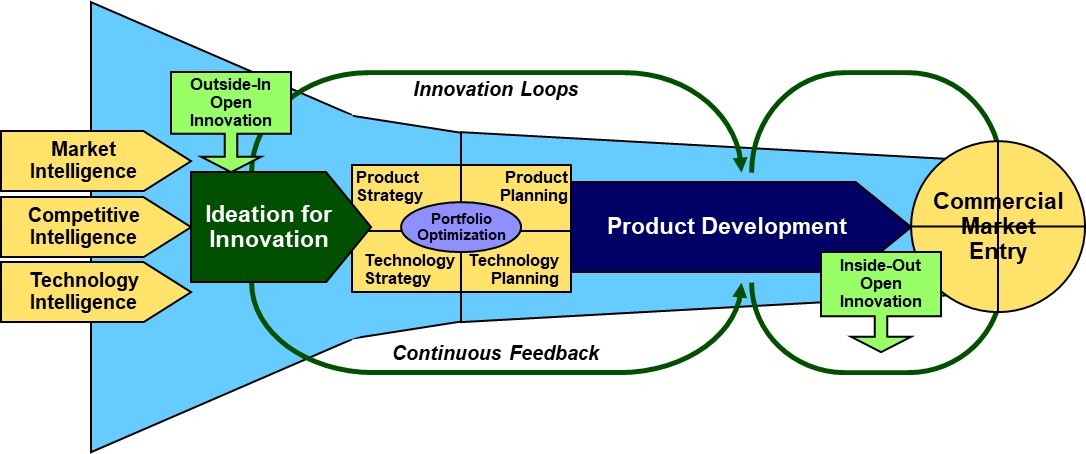

Successful innovation involves clarifying vision and ambitions and aligning business strategy, technology strategy and capabilities

Moving beyond over-aligned and short term business unit driven technical support activities

To robust well-aligned market and ambition driven technology and innovation startegies

In technology and innovation, Edica-Garnett offers a suite of services that spans the product creation process

Innovation Funnel

Innovation and Idea Management

Idea generation, collection/enrichment, evaluation/screening

Technology Resources Development Key Components/Processes, Skills & Competencies

-

Technology & Innovation Strategy Development

-

Open Innovation

-

Technology Roadmaps

-

Technology Assessments

-

Specialized Consumer Research

-

“3dIP – Big Hit” Innovation Process

-

Opportunity Identification

-

Seed Technology Search & Analysis

-

Product Concept Creation

-

Project Identification & Portfolio Optimization

-

Time to Market/Entry Strategy

-

Program Management

-

Contract R&D Support

-

Mft’g Platform Integration

-

Business Model Formulation

-

Acquisitions

-

Venturing & Partnering

-

Licensing

-

Global Strategy

SUSTAINABILITY

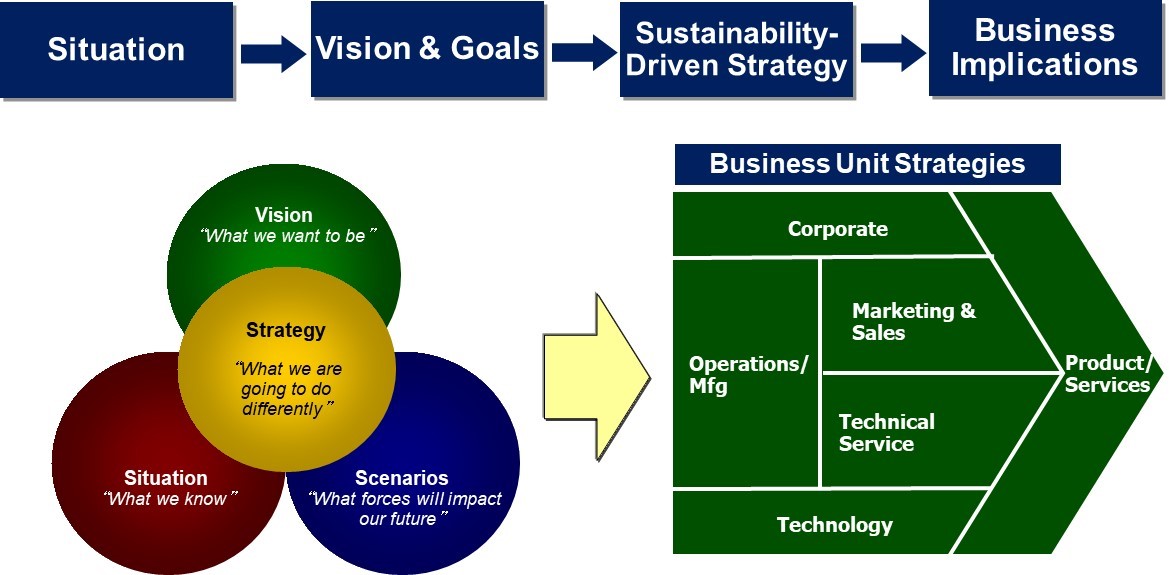

Our overall approach to developing sustainability-driven growth strategies is directly linked to business strategy development...

With the emphasis on using sustainability to drive top-line growth ...

The Key Elements of a Sustainability-Driven Strategy Initiative:

- Benchmarking and gap analysis: competitors, key customers (current and desired) and best in class companies

- “Sustainability Audit” of major strategic business decisions

- Utilizing a Sustainability Scorecard™ to establish a baseline and illustrate gaps

- Defining the business case

- Detailing the roadmap forward – short term and longer term